The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Malaysias goods and services tax GST was.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

It applies to most goods and services.

. Lets start with how GST was abolished. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke. The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

Goods and Services Tax GST in Malaysia. Malaysias recent addition of a Goods and Service Tax GST which was passed by the government during the third quarter of 2011 but delayed until April 2016 has been the. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

At this point in time the rate may be slightly higher. The Royal Malaysian Customs Department Customs had previously issued the following Guides on matters relating to GST adjustments and declarations after 1 September. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

GST has been set at zero from 1 June 2018 to be. Maximum time period to claim the input. Malaysia GST Reduced to Zero.

The Organisation for Economic Cooperation and Development has recommended that the Goods and Services Tax GST be reintroduced in Malaysia as part of the countrys medium-term. The Malaysian government has today thrilled citizens by fulfilling their promise the Malaysian Goods and Services Tax GST will be reduced from 6 to zero come June 1 st. Find out which goods or services are liable to SST when to register and how to pay SST.

On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. GST is also charged on the importation. Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018.

Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the. Abolishment of GST in Malaysia.

GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted. Shoppers in central Kuala Lumpur. Goods and services tax to sales and service tax transition rules.

This guide outlines the topics you need to know about sales and service tax SST in Malaysia. To modernise its taxation system and improve business efficiency Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. The two reduced SST rates are 6 and 5.

Learn about SST within Malaysia. Malaysia Will Consider Goods and Services Tax When Time is Right. We recommend selecting a From date that gives an opening balance of 0 on your report.

GST returns must be submitted to the GST office not later than the last day of the following month after the end of the taxable period. For GST Malaysia there are 3 types of. Malaysia replaced its Sales and Service Tax regimes with.

Until then a transitional arrangement will be in place to help. For more information regarding the change and guide please refer to. Amendment to final GST return.

The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be. However digital services provided but foreigners to consumers in Malaysia exceeding RM 500000 per year will have to register for Service Tax from the start of 1 January 2020. Amendment to final GST return due by 31 August 2020.

Pin By Baasem B F Oo N On منشوراتي المحفوظة Empowerment Anif Mezzanine Floor

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

An Introduction To Malaysian Gst Asean Business News

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

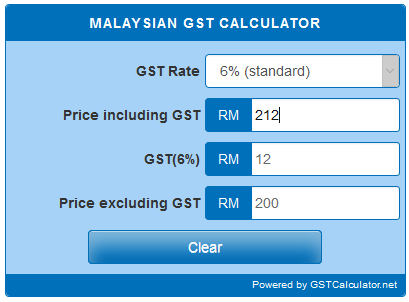

Malaysian Gst Calculator Gstcalculator Net

Casio Adds The All Terrain Gst Bs300 To Its G Steel Lineup Werd Relogio G Shock Acessorios Masculinos G Shock

Casio G Shock Sports Watch Gst S110d 1a Casio G Shock Casio G Shock

Pin On Singapore Malaysia Thailand Group Tours

Pin By Hi Accounts On Accounting Software For Gst Accounting Positive Outlook Accounting Software

Gst Malaysia Goods And Services Tax Brake Pads Malaysia Cal Logo

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

No Decision Yet On Bringing Back Gst Says Ismail Free Malaysia Today Fmt

Malaysia Sst Sales And Service Tax A Complete Guide

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org